Crypto Market Insights - June 2025

Your shortcut to this month’s most important crypto news & developments - plus our take on what really matters

22min minute read

Welcome to the July edition of our Monthly Crypto Market Insights.

In this month’s issue we cover:

Are so called “altcoins” dead - or is there a major asymmetric opportunity beyond Bitcoin?

Crypto adoption keeps accelerating - both as a technology and an asset class. Plenty of news from the last month.

Key market updates, from Circle’s explosive IPO to game-changing U.S. regulation on the horizon

Nothing in this newsletter should be seen as financial advice of any kind; it is intended solely for informational purposes.

The Access Gap

How Structural Mispricing in Crypto Markets Creates Asymmetric Opportunities Beyond Bitcoin and Crypto Stocks

Something feels off in crypto markets this cycle.

Bitcoin broke its previous cycle high (USD 65k) in March last year. Ever since Bitcoin has rallied another +60% and currently sits below its new Alltime High (ATH) of around USD 110k. Yet, there’s no altcoin rotation. No broad-based crypto market rally. No so-called “altcoin season”

The question on everyone’s mind: What’s wrong with altcoins?

That’s the question we tackle in this deep dive.

“Altcoin” stands for “alternative coin”, a term that, while widely used in crypto circles, carries multiple layers of subtle bias.

By definition, an altcoin is anything that isn’t Bitcoin. The implicit message?

Bitcoin is the default and everything else is an alternative, or in many cases, a lesser substitute. That framing is misleading.

First, it suggests that all other tokens are trying to compete with Bitcoin on its own terms, as decentralized money or digital gold.

But most crypto assets have very different goals: they don’t seek to be money. Instead, they power protocols, applications, and decentralized networks across finance, data, infrastructure, gaming, and more. In that sense, they’re not “alternatives” to Bitcoin at all , they represent an entirely different category of innovation.

Second, the term “altcoin” is overly broad. It lumps thousands of fundamentally distinct assets, from deeply technical infrastructure projects to speculative meme coins, into a single, undifferentiated bucket.

For the sake of clarity, we’ll use the term “altcoin” in this article.

But to be precise: When we say altcoin, we mean tech-driven crypto assets, tokens that are tied to real business models, utility and teams behind them. This definition explicitly excludes meme coins and purely speculative tokens.

Understanding this distinction is key to making sense of the market and the argument we’re about to make.

We’ll show you why this cycle’s divergence isn’t random, but the result of structural shifts beneath the surface.

We’ll break down what’s really changed, why it matters, and what’s about to happen next.

Because once you understand these shifts, one thing becomes clear:

There is a deep, structural mispricing in the market. And it likely won’t last for long.

The Pattern and the Break:

Why the market is different this time around

Crypto market cycle theory is almost as old as crypto itself. For good reason:

The patterns have been eerily consistent. Almost ritualistic.

Every four years, a new cycle begins with the Bitcoin Halving, when the issuance of new BTC is cut in half. Each time, Bitcoin moves first. Momentum builds in the market.

Roughly six months after the Halving, Bitcoin sets a new all-time high. Once Bitcoin hits a new ATH, the rest of the market usually follows. Investors rotate from Bitcoin into Altcoins chasing outsized returns. When market exuberance reaches extreme levels, the market reverses into a full-fledged bear market. The bear market low is usually reached about one year after the bull market ends when Bitcoin has bottomed out.

If you're relatively new to crypto, you might think:

That can’t be. This is too simple to be true.

We do agree. But this pattern has been surprisingly consistent so far.

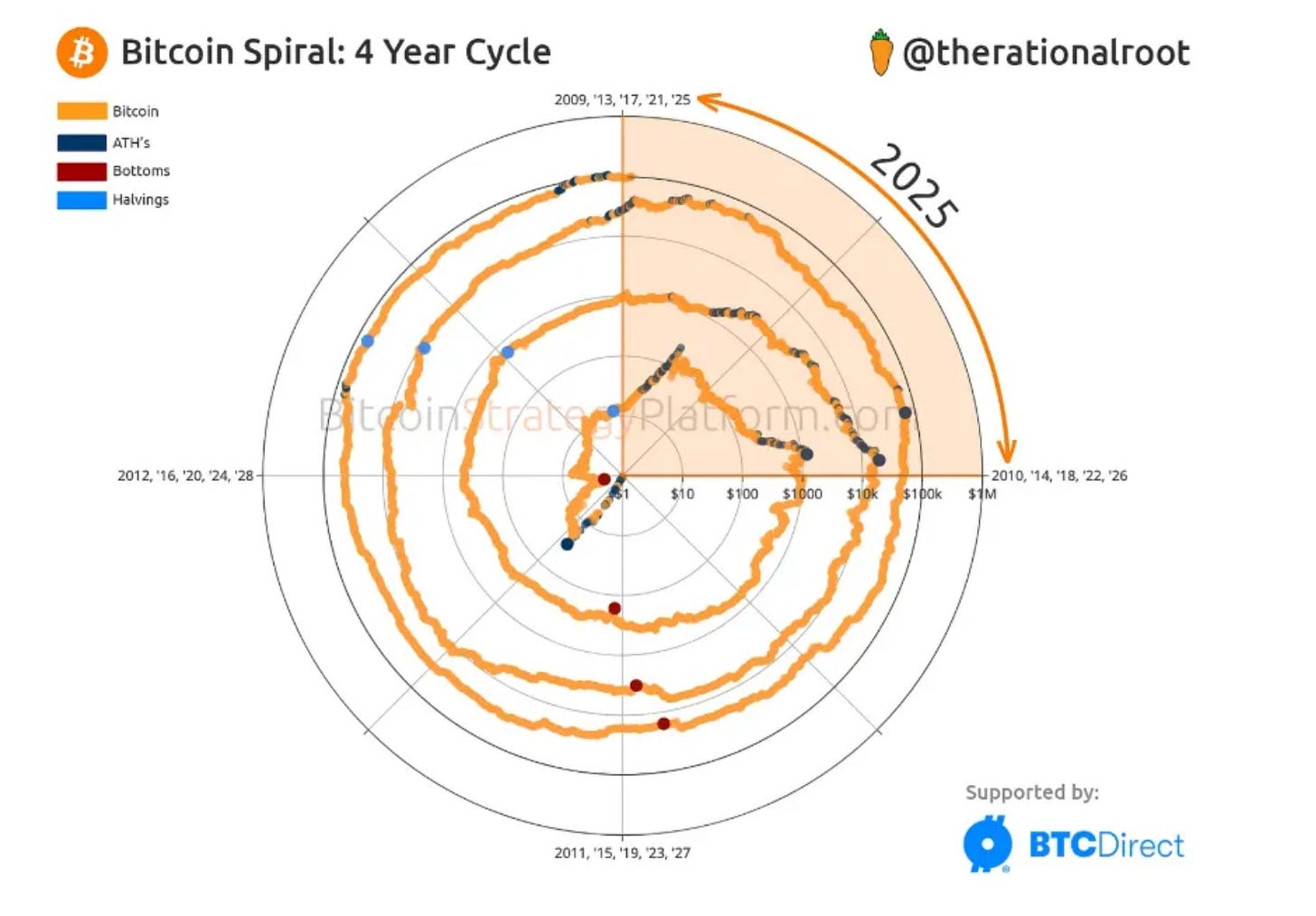

Just look at the chart below.

This spiral chart shows Bitcoin’s price history over time. The orange line tracks price (from $1 at the center to $1M at the outer edge), while time flows clockwise. Each full turn represents one four-year cycle.

Key milestones are marked along the way:

Blue dots show Bitcoin Halvings (when BTC issuance is cut in half)

Black dots mark all-time highs

Red dots indicate bear market bottoms

What do you notice?

Similiar milestones tend to cluster in similar positions across cycles — often within months of each other. That visual pattern is what fuels the idea of the crypto market cylce theory, a recurring market rhythm.

A rhythm crypto investors have learned to trust and rely on.

Year 1: Halving → BTC sets new ATH by year-end

Year 2: Full-blown bull market → Altcoins massively outperform

Year 3: Harsh correction → Welcome to the bear market, bear market low by year-end

Year 4: Slow recovery → Positioning for the next cycle

The 2012-2015 cycle followed this script. The 2016-2019 cycle followed this script. The 2020-2023 cycle followed this script.

Crypto market cycle theory was initially framed as a direct consequence of the Bitcoin Halving — a predictable supply shock that triggered upward price momentum.

Lately, however, an alternative explanation has gained traction:

Some now attribute the repetitive nature of crypto cycles to the short-term debt refinancing cycle in the U.S. This cycle influences interest rate policy, as the U.S. government tends to favor lower rates during periods of heavy refinancing, which increases money supply. And more liquidity/cheaper money means higher prices for risk assets — including equities and crypto.

But here’s the thing:

People always try to explain market patterns in hindsight.

It creates a sense of control, understanding, and certainty.

In reality, cause-and-effect relationships are often too complex, or too opaque, to definitively prove.

At Fountainhead, we’ve long held the view that relying on cycle theory is a flawed approach. The market is evolving too rapidly: structurally, behaviorally, and technologically. Instead, we focus on what the market is actually telling us in real time. Our strategies are built on quantitative models that extract signals from derivatives data and on-chain activity — systematically identifying shifts in positioning, sentiment, and emerging capital flows.

Back to where we stand now:

The current cycle which began with the Bitcoin Halving in 2024 has broken from the pattern.

Bitcoin reached a new ATH already prior to the Halving. An anomaly that didn’t raise much concern at the time, for obvious reasons. And it made sense: Bitcoin’s ETF approval had opened the door to an entirely new class of investors.

But even as Bitcoin continued its climb toward and then beyond USD 100k, something broke:

The rotation to altcoins never came.

This trend is most visible in the Bitcoin Dominance (see chart below):

While the sharp drop in Bitcoin dominance at the end of 2021 reflected a roaring altseason — with altcoins outperforming and gaining market share — the opposite has been true since late 2022.

Since then, Bitcoin has steadily regained dominance.

That simply means: Bitcoin is outperforming everything else.

Yes, altcoins have appreciated in USD terms. See “Total3” in the chart below (shown in turquoise)

Still, their performance pales in comparison to Bitcoin (orange) and to other standout performers of this cycle: Publicly listed equities of crypto-(adjacent) companies like Coinbase (blue), Robinhood (purple), MicroStrategy (green), and more recently, Circle (yellow).

What do all these winners have in common?

They are accessible. They sit inside the regulated financial system. They can be bought via brokers, banks, and institutional fund structures.

That wasn’t the case in previous cycles.

Coinbase didn’t go public until April 2021.

Robinhood followed in July 2021.

Bitcoin ETFs were only approved in January 2024.

Ethereum followed suit in July 2024.

Circle IPOed just weeks ago. It’s price has soared by a staggering +600% as a result of investors trying to frontrun the adoption of the Genius Act (see below)

For the first time, institutions now have direct, regulated pathways to (indirect) crypto exposure, but only in a very limited number of names.

The rest of the market remains locked out.

Altcoins are not listed on public markets. They are not (yet) included in ETFs.

As a result, they lack what these other assets now enjoy:

institutional access, deep liquidity, credible infrastructure, and market visibility.

Despite often promising technology or strong communities, these projects remain financially isolated.

Among all assets accessible through the regulated financial system, Ethereum (red line in above chart) stands out as a negative exception. The protocol has slipped into an identity and leadership crisis and its weak price performance reflects exactly that. We covered the situation in depth in our March newsletter

The pattern is clear: Where access is easy and regulated, money flows.

Where access is hard, fragmented, and unregulated, markets stagnate.

It’s a structural divide and it’s reshaping how capital allocates in this cycle.

The Altcoin Disconnect: Why are altcoins underperforming?

While institutional investors have started to flow into regulated vehicles for crypto exposure, the altcoin market remains overwhelmingly retail-driven.

And retail is overwhelmed.

In previous cycles, the playbook was simple:

Once Bitcoin broke out, you could pick almost any altcoin and expect outsized returns.

Not this time. Investing in altcoins has become far more complex.

The market is highly fragmented, the signals are noisy, and the rules of the game have changed.

What we’re seeing now isn’t just weak sentiment, it’s a fundamental structural shift.

The following dynamics are driving this disconnect.

How low float/high FDV has burned retail investors

At the heart of the altcoin market’s dysfunction lies a single word: asymmetry.

Information asymmetry. Access asymmetry. Incentive asymmetry.

In the early days of crypto, retail investors had a fair chance: ICOs (Initial Coin Offerings) allowed retail investors to back promising projects from day one, often at fair valuations.

Succcessful ICOs like those of Ethereum, Chainlink, Aave, and Maker and others generated outsized returns for early participants.

But after regulators cracked down on ICOs in 2018/2019 (for the wrong reasons), that window closed. What followed was a shift toward VC-style private rounds, where professional investors fund projects long before a token even exists.

By the time a token goes live, only a (small) portion of the total token supply is in circulation. The rest is held by investors and teams, set to unlock over months and years.

To understand the issue, it helps to define the two most common valuation metrics in crypto:

Market Capitalization (Market Cap) = Token price × Circulating supply

Fully Diluted Valuation (FDV) = Token price × Total supply (including locked tokens)

Here’s the problem.

Many tokens in the last cycle (2020-2023) launched with low circulating supply (low float) and high FDV. To retail investors, the project looked “cheap” based on market cap, but that’s was illusion. In reality, the true valuation (FDV) was often in the billions, already pricing in massive future growth.

This created a distorted dynamic:

A false sense of scarcity,

(hidden) inflation through upcoming token unlocks,

price suppression as insiders gradually sold their tokens into the market.

With only a small float available, prices are also easier to manipulate. Retail bought into artificially inflated narratives and became the “exit liquidity”.

The bottom line: Retail investors got burned. Badly.

It’s now widely understood:

Projects with a large share of tokens still locked, or yet to be issue, dare to be approached with extreme caution.

And here’s the deeper issue:

Not every project with a high FDV is predatory. In fact, for many early-stage protocols, a large portion of locked tokens is both necessary and constructive — to fund development, incentivize contributors, and grow the ecosystem.

The structure itself isn’t the problem.

The real problem is this:

Most retail investors can’t tell the difference between a credible, long-term project and one engineered for early insider exit.

Industry leaders have acknowledged the challenges caused by asymmetry and are actively working to establish standardized frameworks for greater transparency and accountability. While this transformation won’t happen overnight, it marks a critical step in the ongoing maturation of this still nascent market.

Zooming Out: The Lemon Market Problem

This inability to distinguish quality from “garbage” is what economists call a lemon market.

It’s a system where information is incomplete, inconsistent, or unreliable — and as a result, buyers lose confidence in their ability to assess value.

Here’s what happens:

Buyers assume the worst.

Because they can’t separate high-quality assets (peaches) from low-quality ones (lemons), they start pricing everything as if it were a lemon.

That doesn’t mean good assets disappear.

It means they get mispriced, trading far below their intrinsic or long-term value.

In crypto, we see exactly that dynamic:

Promising projects with real technology and long-term vision are overlooked

While loud, attention-grabbing tokens dominate headlines and short-term flows

And it’s not hard to see why.

Key information like token unlocks, treasury spending, governance rights, vesting terms is often hidden in obscure publications, not standardized or comparable, or changed mid-course without proper disclosure

The result?

Many retail investors have started to step away from the complexity altogether.

Some rotate back into Bitcoin, where rules are simple and supply is transparent.

Others chase meme coins, where due diligence feels irrelevant by design and expectations are low by default.

Time to recapitulate what we have established thus far.

Altcoins aren’t falling because they’re broken.

They’re falling because two key forces are missing.

Retail has stepped aside worn down by dilution, opacity, and losses.

Institutions, better equipped to deal with the complexities and being more long-term oriented, remain locked out unable to participate without regulatory clarity.

This is the reason why there hasn’t been an altseason this cycle. And frankly, there will likely never be another altseason like those of the past. The market has changed. But that doesn’t mean opportunity is gone. Far from it.

Beneath the surface, a deep structural mispricing remains:

High-quality altcoins - the real blue chips - are trading like second-rate experiments.

It’s important to understand: This is a structural dislocation.

So, where does this leave us?

Is it time to forget about altcoins altogether? Should investors just stick to Bitcoin and crypto-adjacent stocks, the assets with clarity, liquidity, and access?

It’s a fair question.

Because this cycle has made one thing painfully clear:

Without access, value doesn’t matter.

But here’s why we believe that conclusion would be premature and short-sighted.

The Catalyst Is Coming

Here is the thing: This structural dislocation in the altcoin market won’t last.

How do we know?

Because the single biggest unlock is already on the horizon.

Regulatory clarity

Two landmark crypto bills, both with strong bipartisan momentum, are expected to pass in the U.S. by the end of Q3 2025. Together, they will profoundly change the crypto market.

The Stable Coin Bill (GENIUS Act)”:

A regulatory framework for issuing payment stablecoins in the U.S., establishing requirements for issuers, reserving standards, and federal vs. state oversight mechanisms

The Market Structure Bill ("CLARITY Act"):

A comprehensive legal framework defining which crypto assets qualify as securities vs. commodities and how crypto projects can comply. (comparable to Europe´s MiCA regulation)

Together, these two bills will deliver what the industry has waited years for:

A clear legal pathway for crypto assets to be accessed through regulated financial rails.

And paradoxically, the biggest beneficiaries won’t be todays market winners: Bitcoin or crypto adjacent stocks. Those already have regulatory clarity.

It’s the rest of the market. Altcoins stands to gain the most.

Today, they exist in a regulatory limbo. They have no defined legal status. They don’t know what they are.

Or more accurately: Investors don’t know what they are.

And that legal uncertainty is exactly what keeps institutional capital away.

But that’s about to change.

The U.S. is determined to solidify its leadership role in crypto. That goal can’t be achieved through overly restrictive regulation.

It requires legislation that protects investors, without choking innovation.

And that’s what’s taking shape.

Once these bills pass, a new landscape will emerge:

Altcoins will be regulated

Regulated infrastructure will follow

Institutional capital will flow — not just into Bitcoin, but across the asset class

Improved Access

Already today, more than 70 crypto asset ETF applications are pending with the SEC. That number will likely rise significantly once the legal framework is in place.

Because regulatory clarity does more than remove uncertainty, it unlocks infrastructure.

Banks, brokers, and asset managers will finally have the confidence to launch fully regulated products: ETFs, ETPs, and institutional-grade custody solutions. What has so far been fragmented, offshore, or limited to crypto-native platforms will rapidly evolve into broad, accessible, and compliant financial rails.

Where the Smart Money Will Go

Let’s be clear:

Not everything will rally once regulatory clarity has been established.

This won’t be a repeat of the broad-based altcoin mania from previous cycles.

The days when everything goes up are over.

Only quality will move.

Why?

Because institutional investors won’t chase narratives.

They’ll seek out substance — and they know how to find it.

They’re looking for high-quality projects that offer exposure to the three defining crypto use cases of the next decade:

Stablecoins

Tokenization

AI integration

We were going to list a few examples here. But out of respect for legal best practices (and our general counsel's blood pressure), we’ll leave it at that.

But if you want to dig deeper, look for projects that operate in the fields of Layer 1 blockchains, Decentralized Finance (DeFi), infrastructure (especially data), and Decentralized Physical Infrastructure Networks (DePIN).

Then apply the quality filter.

These are the kinds of projects that will stand out:

Projects that address compelling use cases and have real traction to show for it

Projects that have been around for years with stable teams and proven their resilience across multiple market cycles

Projects with active, engaged and long-term oriented communities — contributing to ongoing innovation and ecosystem growth

Projects with transparent, credible tokenomics, built for long-term value creation, not short-term extraction

And if you’re scanning the growing list of ETF applications to identify potential winners proceed with caution. Many view this list as a shortcut to institutional interest. But that’s a flawed path.

It includes:

Serious contenders with strong fundamentals,

Projects with weak traction that portray themselves as credible,

And outright absurditie including meme coins like “Melania.”

Just because a token secures a ticker on a traditional exchange or appears in an ETF filing doesn’t make it a sound investment.

Visibility is not the same as quality. And access is not the same as legitimacy.

In fact, that’s the essence of the lemon market problem we described earlier:

Bottom Line

Our thesis is clear:

There is a deep structural mispricing in the market.

It’s a consequence of restricted access.

Regulatory clarity will unlock that access.

And that will trigger asymmetric repricing in quality assets.

Blue-chip altcoins will be the major winners of this shift.

This won’t be a broad-based rally like in 2021.

It will be more selective and concentrated.

Not powered by influencers. But by allocators who know what they’re doing.

And with most quality assets still valued in the low single- or double-digit billions, the revaluation will be fast, sharp, and impossible to ignore.

And once the shift is underway, retail will do what it always does, chase what the smart money already owns.

And even if this doesn’t materialize as quickly, the long-term trend is clear:

Innovation, real use cases, and most of the new economic primitives are being built in the altcoin market - not on Bitcoin.

Crypto Adoption News in June

Given the widespread confusion around Crypto’s hybrid role, both as a technology and as an asset class, we want to place the below market news in the proper context.

Important: Without Crypto Assets, there would be no blockchains, no tokenization, and no stablecoins. Fundamentally strong Crypto assets play a vital role in powering decentralized blockchains and applications.

We had to leave out some news this month. Too much is going on in Crypto. Let's have a look at the most impactful news.

I. Adoption of Crypto - The technology (Use Cases)

Franklin Templeton introduces intraday yield - unthinkable in today´s financial system

Franklin Templeton launched a new feature on its Benji Investments platform allowing intraday yield on tokenized U.S. government securities via public blockchains. It allows investor to accrue yield based on seconds instead of days. Its essentially “streaming of interest/yield” - unthinkable on traditional financial infrastructure.

Sony Bank pilots innovative DeFi technologies under regulator sandbox

Sony Bank is testing a decentralized exchange (DEX) protocol using automated market maker (AMM) logic. An AMM is a highly innovate tech introduced six years ago by Uniswap - the largest DEX in DeFi. If successful, it could open pathways for compliant, institution-friendly DEX infrastructure - bridging traditional banking with Web3 innovations.

👉🏻 For us DeFi is a huge finance “FinTech laboratory” where innovative tech is developed and battle tested under real and very harsh trading environment. In the future we expect that DeFI tech will be incorporated by traditional financial players - AMMs is a very logical example. This move by the Sony bank is proof that this is already happening.

Amazon and Walmart considering launching own stable coins

According to the WSJ retail giants Walmart and Amazon are exploring the issuance of their own U.S. dollar- backed stablecoins to reduce payment-processing costs and fasten settlement, especially for cross-border commerce. Both are waiting for regulatory clarity under the GENIUS Act. (see below)

JPMorgan Files Patent and pilots JPMD Deposit Token on Coinbase's Base

JPMorgan, through its Kinexys digital asset unit, is issuing JPMD a permissioned, dollar-denominated deposit token on Coinbase’s Base Layer‑2 blockchain. JPMD represents a tokenized bank deposit on‑chain, promising near-instant, low-cost transactions (<$0.01). It should however not be mixed up with other stable coins. Other than a "real" stable coin the JP Morgan token is backed by JP Morgan clients deposit. It’s a permissioned, closed-loop token available exclusively to JP Morgan clients, enabling seamless inter-account transfers across borders, around the clock. While it’s not a public stablecoin, it leverages public crypto infrastructure to streamline what has long been an outdated and costly banking process.

Chinas “Amazon” to Launch Stablecoins for B2B Payments via Hong Kong Sandbox

JD.com, often called "China’s Amazon," plans to launch multiple stablecoins for cross-border B2B payments via Hong Kong’s new regulatory sandbox. Chairman Richard Liu says the initiative could cut global payment costs by 90 percent and reduce settlement times to under 10 seconds. In the shadow of ongoing U.S. stablecoin debates, Hong Kong has quietly already passed a landmark Stablecoin Bill, giving the Hong Kong Monetary Authority (HKMA), the city’s central banking and financial regulatory body, broad oversight. Issuers must meet capital and reserve standards. While crypto remains banned in mainland China, Hong Kong is positioning itself as the country’s digital asset hub, signaling that Beijing sees the need to engage with blockchain innovation.

JV of German DWS Receives License for EUR-AU Stablecoin

AllUnity, a € assets JV between Deutsche Bank’s DWS, Flow Traders, and Galaxy—secured BaFin approval to issue a euro-backed stablecoin, EUR‑AU. Fully collateralized and MiCA-compliant, the coin enables 24/7 cross-border settlement and institutional integration. This positions EUR‑AU as a potential cornerstone of Europe's digital payments ecosystem. It has not been announced on which blockchchain(s) the stablecoin will be launched.

👉 It's about time we get more EUR stablecoins, but we'll see how much, where and by whom the stable coin will be adopted, especially under the often criticised rigid MiCA regime for stablecoins.

II. Adoption of Crypto - The Asset Class

Blackrock Bitcoin ETF reached $ 70bn AUM and is the by far fastest growing ETF in history.

BlackRock’s iShares Bitcoin ETF (IBIT), launched January 2024, became the fastest-ever ETF to surpass $70 billion in assets under management doing so in only 341 trading days, roughly one-fifth the time of SPDR Gold Shares (GLD). This milestone cements Bitcoin’s transition into mainstream portfolio infrastructure and underlines Bitcoins increasing role as a macro hedge.

Spains second largest bank and #17 in Europe encourages 3–7% crypto allocation for wealthy clients

Spain’s BBVA - comparable in size to UniCredit - is now officially advising its private banking clients to allocate 3 to 7 percent of their investment portfolios to Bitcoin and Ether, depending on their risk appetite. The bank began recommending crypto allocations in September 2024 after offering trading and custody since 2021. BBVA plans to expand advice to more digital assets later this year. BBVA is the first major bank that takes a pro-active approach and does not leave their clients alone in what to buy. We believe it will not remain the last bank that takes this step. But in order to be able to do this a bank needs to build knowledge about this new asset class. We also shortly wrote about this on LinkedIn.

Fannie Mae & Freddie Mac are requested to Consider Crypto in Mortgage Reviews

The U.S. Federal Housing Finance Agency (FHFA) has ordered the two U.S. government-backed mortgage finance giants Fannie Mae and Freddie Mac to propose ways to include crypto holdings in mortgage loan risk assessments. The directive applies only to crypto kept on U.S.-regulated centralized exchanges. Borrowers previously had to liquidate crypto assets into dollars to count them toward creditworthiness.

Mastercard and Chainlink Enable On‑Chain Crypto Buying With 3.5 Billion Cards

Mastercard has partnered with Chainlink to enable crypto purchases directly on decentralized exchanges like Uniswap using any of the 3,5 billion Mastercard cards. This is the first time major card payments can be used for fully on-chain asset acquisition, from Bitcoin to stablecoins, without the need for centralized exchange accounts or wallet setup.

Bhutan Quietly Mines Bitcoin Worth 40% of Its GDP with excess energy.

Bhutan has secretly mined about 12,000 BTC, now worth roughly $1.3 billion, under royal direction. It used surplus hydroelectric power to convert clean energy into digital reserves. The BTC reserve equals nearly 40% of the country's GDP and places Bhutan among the top sovereign Bitcoin holders alongside the United States and China. In 2023 the government has already sold $100 million worth of Bitcoin to raise civil servant salaries, helping to reduce staff turnover and prevent a public sector exodus.

German Sparkassen Group to Launch Crypto Trading by Summer 2026

Germany’s largest banking network - Sparkassen‑Finanzgruppe - will allow its ~50 million retail customers to trade Bitcoin, Ethereum, and other digital assets via its mobile banking app, powered by DekaBank.

Deutsche Bank Teams Up with Bitpanda for 2026 Crypto Custody Rollout

Deutsche Bank plans to launch an institutional-grade crypto custody platform in 2026, partnering with Bitpanda Technology Solutions and Swiss custodian Taurus. Bitpanda, an Austrian unicorn and regulated brokerage, will provide the tech infrastructure.

Thanks for reading Fountainhead Digital - Monthly Crypto Market Insights! Subscribe to receive the next publication in your inbox.

About Fountainhead Digital

Fountainhead Digital is a crypto research, investment, and analytics firm. Our founding team brings together 20+ years of experience in Crypto, expertise from traditional venture capital, on-chain data analytics, and traditional finance.

At Fountainhead, we cut through the hype around crypto to uncover the real potential of this emerging technology and asset class. We understand the market’s complexity, its volatility, rapid innovation, and emotional cycles. We take a disciplined, data-driven, and unbiased approach, allowing us to navigate this evolving space with clarity and conviction—free from ecosystem or project-specific biases.

Together with our partners, we enable a diversified and professionally managed exposure to the liquid crypto market, tailored to professional and institutional investors. Our unique, data-driven strategies are designed to capture directional long exposure to the emerging crypto and Web3 markets while mitigating their high volatility.