Crypto Market Insights - March 2025

Your shortcut to this month’s most important crypto news & developments -- plus our take on what really matters

13 minute read

Here's what's inside this month’s issue:

The “Trump Dump” of March — What really happened and why it matters

Institutions are bullish on crypto — Key insights from a recent study

Is Ethereum dead — or long live Ethereum? Our take on the debate

Major crypto IPOs could be just around the corner — What to watch for

March adoption highlights — Who’s jumping on the crypto bandwagon?

March 2025 - “The Trump Dump”

“A meme says more than a thousand words”

… and in numbers:

Now explained in less than a “thousand words”….

The month kicked off with confusion on a Sunday, March 2nd, when Trump posted an opaque message on social media about an upcoming “strategic crypto reserve.” Markets reacted instantly — crypto prices soared, only to give up all gains the very next day. The reason? Rising fears around tariffs, once again triggered by Trump. It might have been the fastest $300 billion market cap rise and fall in crypto history.

Things calmed down afterwards with a slight recovery, but by month-end, markets dropped again as investors anticipated the April 2nd tariff “liberation day” announcement by Trump.

There isn’t much more to say except that crypto markets are currently unable to escape the broader global fear and uncertainty around tariffs.

However, crypto-specific fundamentals remain very strong, and positive news continue to come in on a weekly basis. Lets focus on that going forward.

Institutional investors are very bullish according to a recent survey by Coinbase

Coinbase together with EY recently conducted a global survey among 352 institutional investors. 62% of the participants were from the US and 28% from Europe. The survey was done throughout January 2025.

The results confirm that institutions are very bullish on crypto as an asset class.

• 83% plan to either increase or significantly increase their allocation in 2025.

• 59% plan to allocate over 5% of AUM to crypto.

Coinbase’s Head of Strategy calls the 5% mark a key hurdle. Fund managers need LP approval to shift that much into a new asset class — and they’ll only do that if they’re truly convinced.

• 73% hold more than just Bitcoin

• 60% plan to get exposure via regulated vehicles (like ETF/ETP) and don't want to hold Crypto directly.

The survey also revealed the top concerns institutions still have about crypto. The three biggest are:

Regulatory uncertainty

Volatility of the asset class

Security of asset custody

The first concern is starting to fade. In the U.S. and regions like the EU (thanks to MiCA), regulators are slowly creating clearer and more crypto-friendly frameworks.

The third concern is improving as well — with ETFs, ETPs, and crypto funds now offering exposure without the need for self-custody.

But the second concern — volatility — isn’t going anywhere anytime soon. It's a fundamental challenge, and it’s one we tackle head-on with our strategy.

If you are interested to know how we reduce volatility while not giving up directional long exposure, reach out to us! Spoiler: we do this based on unique data that is only available in crypto.

Is Ethereum dead - or long live Ethereum?

Ethereum is having a hard time. The price of Ether (ETH) - denominated in Bitcoin - reached its lowest level since years and the community is getting nervous.

Voices recently become ever louder that this is the beginning of the end of Ethereum. Will Ethereum eventually become the often quoted “Yahoo of crypto? Was Ethereum simply too early or will the “King” strike back?

Lets have a closer look on both perspectives.

“Ethereum is dead” - A bearish take 🐻

It recently made the news that the price of Ether just hit a 5-year low compared to Bitcoin.

The chart doesn’t look good — at all. But let’s put things into perspective:

In USD terms, Ethereum is still up a not-too-shabby +700% over the same time frame.

For comparison: Over the this last 5 years, the S&P 500 is up +95%, while Gold has gained +80%.

So, why the growing nervousness around ETH then?

To make sense of it, we need a short tour through crypto history.

Ethereum was the first so-called "smart contract blockchain" to follow Bitcoin.

It unlocked a wave of unlimited innovation— unlike Bitcoin’s intentionally rigid design. Smart contracts made many of today´s blockchain use cases possible, such as DeFi, DePin, Tokenization, dAI and many more.

Ethereum has often been dubbed the World Computer or the Decentralized Appstore , clearly benefiting from its first-mover advantage.

But Ethereum’s early success quickly pushed the network to its limits. Compared to newer generations of blockchains, Ethereum is relatively slow — and as demand surged, transaction fees on the network skyrocketed.

Around 2018–2019, a wave of alternative Layer 1 blockchains emerged — often dubbed “Ethereum killers”. These included Solana, NEAR, Avalanche, and, more recently, Aptos and Sui.

These chains were built to overcome Ethereum’s early trade-offs. They’re faster, cheaper, and more user-friendly — and they’ve proven it not just in theory, but in practice.

Ethereum’s original plan to solve its scaling issues was through so-called “sharding” — a method of splitting the blockchain into multiple parallel chains that can communicate with each other. Think of it like an airport adding more runways to handle more planes at once.

But putting sharding into live production turned out to be extremely complex — and the roadmap dragged on far too long.

Now, we need to get a bit techy — but don’t worry, we’ll keep it simple.

A blockchain transaction process is split into three different “production steps” (layers). One could also split settlement and consensus into two separate steps but we keep it simple and combine them.

Data availability layer (DA): Holds the current state — all info needed to execute a transaction.

Execution Layer: Processes the transaction and updates the state (e.g., moving assets from A to B).

Settlement layer (including consensus) - Verifies and finalizes the new state — fully decentralized and immutable.

Due to the scaling challenges associated with sharding, Ethereum pivoted to a so-called rollup-centric roadmap. The idea is to outsource the execution layer to third-party blockchains — known as Layer 2s (L2s) — to reduce congestion on the main Ethereum chain (Layer 1 or L1).

Think of it like Ethereum shifting from a direct sales model to working with distributors. The L2s handle the customers (i.e., transactions), bundle them together, and send them back to Ethereum in one large batch — a rollup. This approach is designed to significantly increase throughput.

And it worked. Just three years ago, Layer 2s processed only half the number of transactions seen on the Ethereum mainnet. Today, they handle 15 times more than the mainnet itself.

So whats the problem then, one might ask?

There are a couple of problems…

Rising complexity

Today, we have dozens of general-purpose Layer 2s like Base, Arbitrum, zkSync, and Optimism — along with more than a hundred specialized L2s, known as app chains. Add to that external data availability (DA) layers like Celestia — the second component in the execution pipeline mentioned earlier — and things get even more complex. Interoperability and communication between these layers have become major challenges.Liquidity fragmentation

DeFi's lifeblood — liquidity — is now spread across many L2s. This hurts network effects and limits growth. Interoperability solutions are in progress, but still far from ideal.

Ethereum gives up fee revenue

The most important and critical point: Ethereum's fee revenue is in a continuous downward spiral. The reasons are complex and would go beyond the scope of this letter. But in short: Ethereum’s roll-up centric roadmap has made transactions significantly cheaper and has shifted a meaningful share of fee revenue to Layer 2 networks. This design change has reduced the possibility to capture value by the Ethereum base layer itself. Its clearly visible in the below chart which shows the weekly fee revenue.

Today, unlike in 2020 or 2021, more and more investors are paying attention to the fundamentals of crypto projects — metrics like fee revenue.

So what happens when an investor looks at a blockchain whose revenue is in constant decline? They might lose confidence — and exit.

That’s probably the #1 reason why Ethereum’s price is where it is today: in decline.

But there’s also another way to look at this. More on that in a moment.

Meanwhile, the Ethereum Foundation (EF) is well aware of the growing issues with the rollup-centric model. Leadership within the EF has shifted, and the broader community is now pushing to refocus on scaling Ethereum’s mainchain directly — rather than relying solely on Layer 2s.

It’s a critical juncture.

Ethereum’s decentralized governance fosters trust and long-term resilience — but it comes with trade-offs: slower progress, less top-down direction, and often a weaker focus on user experience when compared to faster-moving competitors like Solana.

“Long live Ethereum” - A bullish take 🐃

1. By far most TVL is on Ethereum main chain

TVL (Total Value Locked) is a key metric to measure DeFI activity on a blockchain, - it shows how much capital is actively put to work in DeFi protocols built on that chain. Ethereum leads with nearly $50B TVL (~53% market share). Solana comes next with around $7B (~7%). Most blue-chip DeFi apps — Uniswap, Aave, and Sky (ex-Maker) — are built on Ethereum. This strong TVL suggests one thing:

When big money is involved, trust and security matter more than speed (at least for certain DeFI use cases)

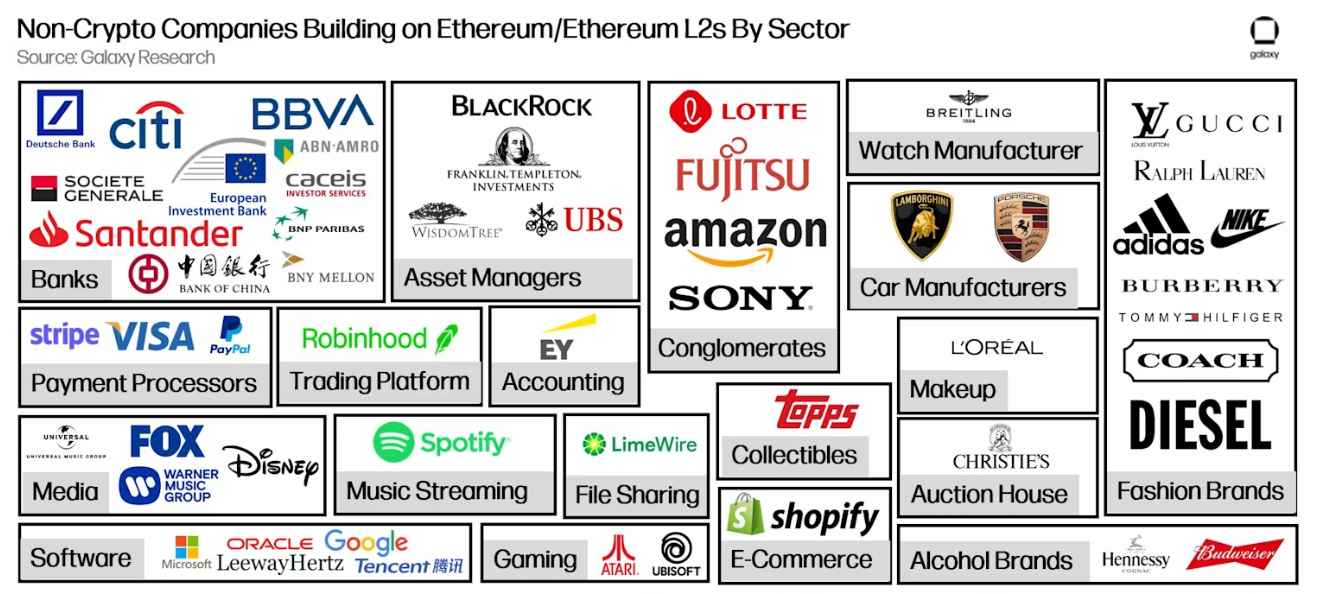

2. Institutions and cooperations are mostly building on Ethereum

In this category, Ethereum still stands unrivalled. Despite the challenges mentioned above, most large institutions remain confident in its long-term potential. Many are either launching products directly on the Ethereum mainnet or building their own Layer 2 chains on top of it — with Sony being one of the most recent examples.

Why Ethereum?

Because it’s reliable, battle-tested and seen as the most neutral (most decentralized) infrastructure — all important factors for institutions.

3. Ethereum is the leading in tokenization platform for Real World Assets (RWA)

Tokenization of Real World Assets (RWA) has been gaining momentum over the last months. And again the #1 choice for the largest asset managers in the world to tokenize assets is Ethereum. As of today roughly $ 20bn in RWA assets are “living” onchain - out of which 55% have beeen tokenized on Ethereum. Just look at BlackRock (with its “BUIDL” money market fund), Franklin Templeton, and more recently Fidelity — all of them started on Ethereum before expanding to other chains.

4. Ethereum has the most dominant developer community

One of Ethereum’s biggest strengths is its massive developer community — around 2,600 full-time devs (vs. 580 on Solana). Solidity - Ethereums smart contract coding language - may not be the most advanced language, but the most widely known and used.

In a world of open source software, this creates a powerful network effect — more developers means faster innovation, more tools, and a stronger ecosystem overall. Network effects are hard to break.

But it’s not a guarantee either.

If Ethereum fails to make progress, developers might slowly move to ecosystems where they can make a bigger impact.

5. Fee revenue is just one metric. It might be too short-sighted to focus on it alone

It’s natural for investors to look for measurable data — ideally revenue or profit — to build valuation models. In the long run, this will undoubtedly be necessary. But not necessarily in the short term. Ethereum is undergoing a complex and long-term shift toward a more B2B-focused model. This could strengthen its network effects and, over time, enable it to generate more value than smaller competing networks.

Our Conclusion: For now.. Long live Ethereum

Ethereum is still the most trusted chain — by capital, by institutions, by developers. Yes, it has challenges. Yes, the price has underperformed. But when the world’s largest asset managers choose Ethereum, it shows one thing: trust matters. And in crypto, trust often comes only with time — this is the Lindy Effect at work. Yes, short term it might look weak on common metrics like fees. But long term, Ethereum can build a powerful network around the mainchain — the most trusted base layer in crypto. But it must not rest upon its success and speed up. Competition is not sleeping.

Crypto offers tremendous upside potential — but that comes with higher risk. Most projects (except Bitcoin) are still in the startup phase, operating in a fast-moving and entirely new market.

And because everything in crypto is open-source, the speed of innovation is unparalleled. — what’s cutting-edge today might be outdated tomorrow.

That’s why we believe passive investing is still too risky in crypto. One needs to stay on top of the market and monitor developments closely.

So yes, for now, we remain optimistic on Ethereum (not financial advice).

But one thing has become increasingly clear in recent months: the old “standard first-time crypto investor strategy” — just holding Bitcoin and Ether — is no longer as safe or simple as it once seemed.

If you are a wealth manager, asset manager or multi family office and want to explore, learn or get active in the crypto market but don't know how? We enable wealth managers and institutional investors to integrate the digital assets with clarity and confidence.

Imminent Crypto IPO season as market catalyst?

In recent weeks, news and rumours about crypto companies preparing for IPOs have spread. This is not surprising given the change in regulatory environment in the US. Many companies that planned IPO skipped their plans due to the hostile SEC. Now this all changed and many reassume plans.

The hottest IPO candidate is notably Circle - the issuer of second largest stable coin USDC. Circle filed for an IPO only a few days ago. Other candidates are Kraken and Gemeni two of the oldest US crypto exchanges or eToro, a traditional equity broker that has quietly become a crypto-first company — with 96% of its revenue deriving from crypto.

Ripple, on the other hand — the company behind XRP — had IPO plans earlier, but currently indicated no clear interest or priority in going public.

A crypto IPO season 2025/2026 from such well-known players could become a strong catalyst for the broader market.

Adoption News - Crypto as a technology and an asset class

Deutsche Börse expands crypto offering

Deutsche Börse will offer institutional access to Bitcoin and Ethereum via its subsidiary Clearstream starting April 2025. This move reinforces its crypto expansion following the 2021 acquisition of Crypto Finance, a Swiss crypto broker.

Robinhood expands into private wealth management to prepare for the generational wealth transfer.

Robinhood, the fintech broker generating growing revenues from crypto, is now expanding into private wealth management — including the offering of research and managed portfolio strategies and private banking. CEO Vlad Tenev continues to emphasize the company’s focus on the multi-trillion dollar “Great Wealth Transfer” — aiming to serve the younger generation inheriting massive wealth over the next decade.

We combined numerous studies and reports about the “Great wealth transfer” the role of Crypto and the implications for wealth- and asset manager. If you are interested to receive the presentation please reach out to us. insights@fountainhead.digital

Abu Dhabi wealth fund invested $2bn into Binance

Abu Dhabis MGX secured a minority stake in Binance through a $2bn investment. It was not only the biggest equity investment into a crypto company ever, but was also fully settled in stablecoins, making it the biggest transaction of its kind.

Fidelity doubles down on Crypto

Fidelity - a $5 trillion asset manager - is entering the tokenization race. Fidelity is launching an onchain money market fund on Ethereum to boost efficiency and transparency — following similar moves by BlackRock and Franklin Templeton.

Reminder: Tokenized assets are still the same assets (fund shares, bonds etc..) – they just receive an onchain wrapper (digital twin). This brings efficiency, transparency, lower cost and access to new markets. Important for crypto investors: More tokenization = more onchain activity = more demand for native crypto assets (like ETH, SOL etc..), which are needed to pay for network usage. Fidelity, Blackrock and Co. economically become customers of the underlying decentralized blockchain.

And since this month was also characterized by the latest hot AI trend of turning real photos into Ghibli-style pictures with ChatGPT-4o, we “gave in to the viral pressure” and are closing with “ghiblified” greetings from Vienna.

About Fountainhead Digital

Fountainhead Digital is a crypto research, investment, and analytics firm based in Vienna. We enable wealth managers, family offices, and institutional investors to integrate digital assets with clarity and confidence.

Our team combines deep expertise from venture capital, on-chain analytics, and traditional finance. We combine deep market expertise with a disciplined, strategic approach, ensuring that our clients integrate digital assets in a way that is structured, compliant, and risk-optimized. Our focus is on balancing opportunity with risk awareness, applying institutional-grade standards in investment and advisory strategies.

📩 Looking to integrate digital assets with confidence? Reach out to us: insights@fountainhead.digital

Disclaimer

This article is for informative and educational purpose only. Nothing in this report shall be regarded as financial advice. No token or asset mentioned in this report shall be seen as an endorsement or as financial recommendation.